Having a decreasing turnover ratio does not necessary mean the company does not have the financial capacity to pay debts, rather, the company may be reinvesting in the business.The turnover ratio also indicates the number of times the company pays it debts in a given period.An accounts payable turnover ratio is a liquidity ratio (short-term) that measures how well a business pays off its accounts payable during a period of time.Here are some important points to hold onto: When a company is spending all its revenue to pay off debts without reinvesting into the business, it will have an increasing turnover ratio which is not healthy for the growth of the company. However, an increasing turnover ratio is not always a positive indication, it could be as a result of failure of the company to reinvest in the business. It also indicates some level of financial strength in the company. An increasing turnover ratio indicates a positive management of short-term debts and accounts payable by a company. An Increasing Accounts Payable Turnover RatioĪ company that has an increasing accounts payable turnover ratio pays off its debt at a faster speed when compared with previous periods. On the other hand, having a decreasing accounts payable turnover could mean that the company has negotiated with suppliers it owes. A company that takes longer time before paying off clients of regarded weak financially, thereby not attractive to investors. When a company takes longer time to pay off short-term debts, it will have a decreasing turnover ratio. A Decreasing Accounts Payable Turnover RatioĪ company can either have a decreasing turnover ratio or an increasing turnover ratio. It also measures the extent at which the company meets short-term debt obligations.

Basically, the accounts payable turnover ratio of a company is an indicator of the amount of cash or revenue the company owns. Also, the number of times a company pays off its accounts payable is reflected in the turnover ratio. The accounts payable turnover ratio of a company is an indicator of solvency or insolvency of a company relating to how quick a company pays off debt or owes its suppliers. What Does the Accounts Payable Turnover Ratio Tell You? Second, you can divide the total accounts payable for the beginning and end of the period by 2. First, you can deduct the accounts payable balance at the beginning of the period from the accounts payable balance at the end of the period to arrive at the average.

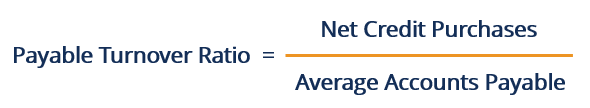

There are two ways of calculating the average accounts payable of a company. The Formula for calculating the accounts payable turnover ratio is The accounts payable turnover ratio is a liquidity ratio that compares the net credit purchases by a company to the average accounts payable at a particular time.

AP TURNOVER DAYS HOW TO

The ability of a company to pay off accounts payable and how efficient it is in paying is reflected in the accounts payable turnover ratio of the company.īack to: Accounting & Taxation How to Calculate the Accounts Payable Turnover Ratio This ratio is a short-term, liquidity ratio that measures the number of times a company pays off its suppliers during a period of time.Īccounts payable is the short-term debt a company owes is suppliers. The amounts payable turnover ratio of a company is the rate at which a company pays the debts that it owes its suppliers or vendors.

AP TURNOVER DAYS UPDATE

Update Table of Contents What is the Accounts Payable Turnover Ratio? How to Calculate the Accounts Payable Turnover Ratio What Does the Accounts Payable Turnover Ratio Tell You? A Decreasing Accounts Payable Turnover Ratio An Increasing Accounts Payable Turnover Ratio Example of the Accounts Payable Turnover Ratio The Difference Between the Accounts Payable Turnover and Accounts Receivable Turnover Ratios Limitations of Using the Accounts Payable Turnover Ratio What is the Accounts Payable Turnover Ratio?

0 kommentar(er)

0 kommentar(er)